Have a look at what happened in Durham Region real estate last year, where are we at now, and what it means for the 2023 market.

HOW IT STARTED

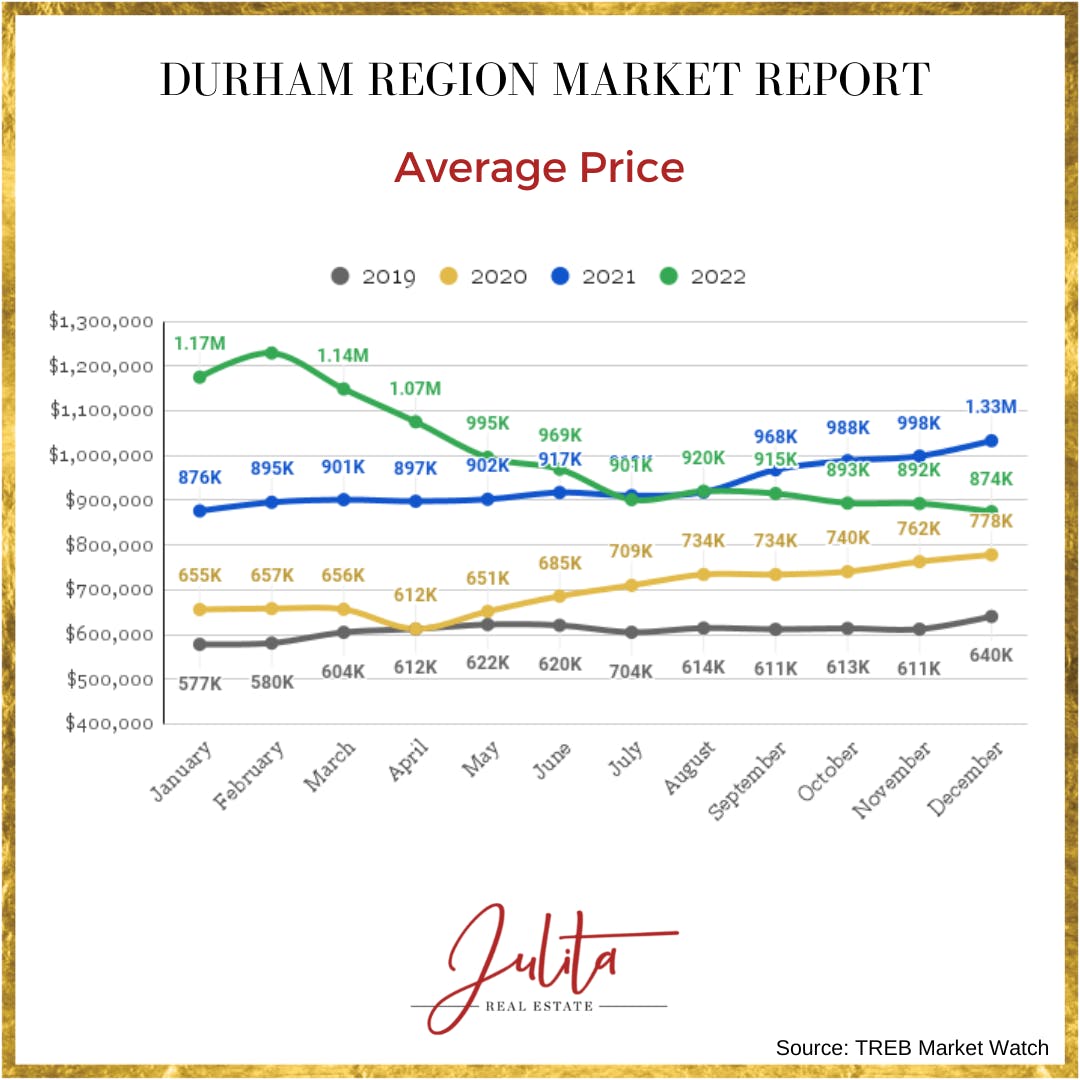

Despite the Ontario lockdown in the beginning of last year, the roller coaster of the market was on a rapid incline. In January average prices were 14% higher than merely a month earlier and still much lower than the 2022 highest price point around Valentine’s Day.

Here is the breakdown of activity in January 2022:

Average price: $1,175,010

Sales: 609

New listings: 874

Months of inventory: 0.5

Days on Market: 7

Bank of Canada’s policy interest rate in January 2022 was at 0.25%. After 7 increases throughout the year to help fight inflation, the year ended at 4.25% interest rate with a 4 percent total increase.

THE RESULT

With higher mortgage interest rates affecting the buyers purchasing power, the market responded with lower sales prices to offset the increase in costs of borrowing. Overall the average price in Durham has decreased by 25.6% between January and December monthly averages.

Here is the breakdown of activity in December 2022:

Average price: $874,456

Sales: 380

New listings: 458

Months of Inventory: 1.3

Days on Market: 21

The average selling price for the year in Durham Region was $1,024,570 – an increase of almost 11% over 2021, however the increase was driven by the aggressive first 4 months of the year, before changes in borrowing costs (after a brief moment of suspense) sent the market on a downhill track. In comparison, during the pandemic period of low interest rates, Durham average price for 2021 increased by 31% from 2020, and by almost 16% from 2019 to 2020 (as shown in the graph above).

Locations that experienced the fastest growth during the pandemic were most affected by rapid reductions in prices last year. In the GTA, markets in Oakville, Caledon, Burlington, Richmond Hill, Whitchurch-Stouffville have seen the largest changes between January and December.

In areas with a variety of housing types, such as Durham Region, communities with rural and luxury homes have experienced the greater correction in value, while buyer demand for entry and mid level homes in subdivisions combined with the lack of inventory resulted in lower corrections in urban areas.

Here is a look at market correction across Durham Region communities (from January to December):

Ajax: -28%

Brock: -34%

Clarington: -34%

Oshawa: -21%

Pickering -22%

Scugog: -34%

Uxbridge: -33%

Whitby: -19%

While the change may seem drastic, it’s important to keep it in larger perspective. Despite the correction, the average selling price of December 2022 is 37% higher from pre-pandemic December of 2019.

HOW IT IS GOING

These statistics can also be deceiving to homebuyers who are expecting a “buyers market”. Due to low inventory, many of Durham Region homes (particularly entry level homes in urban areas) continue to sell with bids from multiple buyers and over the asking price – a trend that is expected to continue throughout the year, unless inventory will expand giving home buyers a lot more properties to choose from. First time buyers entering the market this year should be armed with strategies to win in competitive market and a solid mortgage pre-approval.

Multiple offers doesn’t always equal firm offers – although offers with no conditions are still a common occurrence (depending on property type) – we are seeing an increase of sales contingent on buyer’s conditions of home inspection and financing.

The next Bank of Canada policy rate announcement is on January 25. Undoubtedly, interest rates and low inventory will be the most important factors affecting the market in the coming months. Many buyers who are eager to take advantage of lower prices are slowed down by the lack of available homes for sale. If interest rate will increase again, we’re likely going to see further price corrections this spring and tighter inventory. On the other hand, if rates will stay put for a while, we might see more listings on the market as the weather warms up.

The great news is that after the roller coaster of the last 3 years we are now heading towards more stable market and much desired moderation.